Managing payroll efficiently is one of the most crucial aspects of running a business. Yet, for many companies, the process can become time-consuming, error-prone, and costly. With payroll outsourcing and HR outsourcing services gaining popularity, businesses are increasingly turning to these solutions to streamline their payroll processes. This blog will guide you through how outsourcing payroll to HR providers can help simplify your operations, reduce errors, and improve your overall efficiency.

What is Payroll Outsourcing?

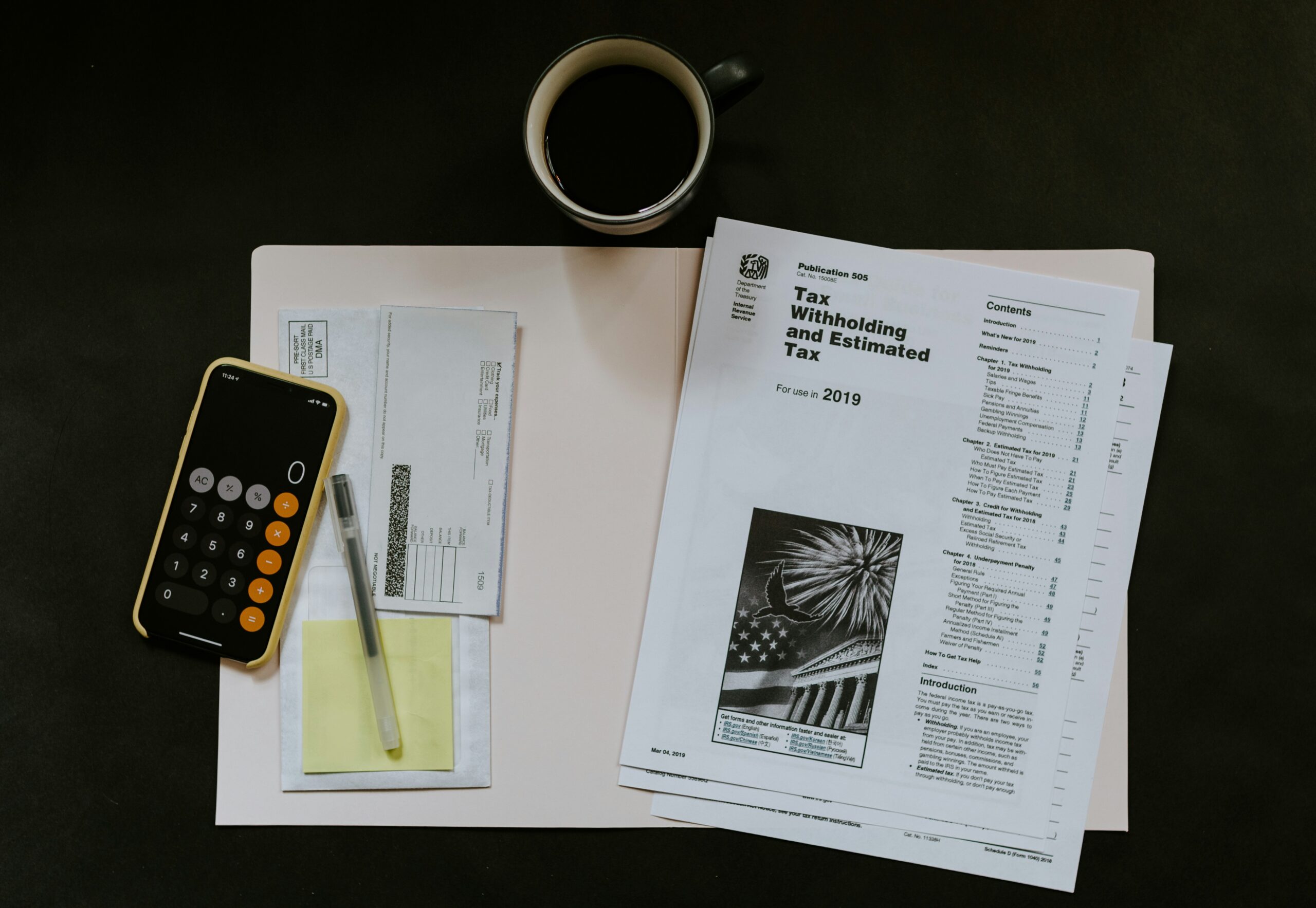

Payroll outsourcing refers to the practice of delegating the payroll processing function to an external service provider. This service typically includes calculating wages, withholding taxes, issuing paychecks, and managing compliance with various tax regulations. By using payroll outsourcing, businesses can free up time, reduce errors, and ensure compliance with ever-changing tax laws.

How HR Outsourcing Helps Streamline Payroll?

Integrating payroll outsourcing with HR outsourcing is a game-changer for businesses looking to improve their operational efficiency. HR outsourcing involves contracting out HR functions such as recruitment, benefits management, and employee relations to a third-party provider. When these services are combined, they create a seamless flow of payroll processes that not only ensures timely and accurate payments but also enhances employee satisfaction.

By relying on an experienced HR provider, businesses can streamline payroll tasks like tax calculations, deductions, benefits administration, and more, while eliminating the need for internal payroll teams.

Step-by-Step Guide to Streamlining Payroll with HR Outsourcing

- Evaluate Your Business Needs

Begin by assessing the specific payroll challenges your business faces. Is it the complexity of tax filings? The time spent on data entry? Or are there frequent payroll errors? Identifying your pain points will help you choose the right outsourcing solution. - Research Payroll Outsourcing Providers

Not all payroll providers are created equal. Look for a service that offers automation tools, compliance management, and excellent customer support. Choose a provider with experience in your industry and one that can integrate seamlessly with your existing HR systems. - Outsource Payroll to an HR Provider

Once you’ve selected your provider, hand over the payroll process. An effective HR provider will handle everything from pay calculations to tax filing, ensuring your payroll runs smoothly. - Automate the Payroll Process

Payroll process automation is a key benefit of outsourcing. Automating tasks like time tracking, salary calculations, and tax reporting helps eliminate human error and ensures timely payments. - Monitor and Optimize Payroll Services

Even after outsourcing, monitoring payroll performance is crucial. Regularly assess the quality of service and make adjustments as necessary. Good HR providers will work with you to continuously refine processes and improve efficiency.

Benefits of Outsourcing Payroll Services

The advantages of payroll outsourcing are numerous and can have a significant positive impact on your business operations:

- Reduced Payroll Errors

Payroll errors can result in costly fines and dissatisfied employees. With outsourced payroll services, businesses can minimize these mistakes, ensuring greater accuracy. - Time and Cost Savings

Outsourcing payroll allows internal resources to focus on other critical tasks. By eliminating the need for in-house payroll management, you save both time and money. - Access to Expertise

Payroll outsourcing providers are specialists in their field. They stay updated with the latest regulations and tax laws, ensuring your business is always compliant. - Scalability

As your business grows, so do your payroll needs. Outsourcing ensures that your payroll system can scale with your company, preventing growing pains as your team expands.

What to Expect When Outsourcing Payroll

When you outsource payroll to an HR provider, expect a seamless transition. Initially, you’ll need to provide the necessary employee data, pay rates, and tax information. From there, your provider will take care of all payroll functions, including direct deposits, tax filings, and compliance.

A well-executed payroll outsourcing solution can integrate directly with your existing systems, saving time and reducing the chance of errors. Most importantly, the HR provider will be your go-to resource for any payroll-related questions or concerns.

Best Practices for Outsourced Payroll Management

To get the most out of your payroll outsourcing arrangement, follow these best practices:

- Choose a Trusted Provider: Ensure that your provider is reliable and has a proven track record in payroll management.

- Maintain Clear Communication: Regularly communicate with your provider to ensure everything runs smoothly.

- Stay Informed About Tax Law Changes: Even though your provider will manage taxes, staying informed about tax law changes will help you make informed decisions.

- Ensure Data Security: Protect your sensitive employee data by choosing a provider that offers strong data security measures.

How RAHA Financials Can Help You Streamline Payroll?

At RAHA Financials, we understand the importance of payroll accuracy and efficiency for businesses. With our HR outsourcing and payroll management services, we help small businesses streamline their payroll processes, reduce errors, and ensure compliance with the latest tax regulations. Our team of experts provides a step-by-step approach to outsourcing payroll, ensuring that every aspect of your payroll system runs smoothly.

If you’re ready to simplify your payroll process and reduce the burden on your team, contact RAHA Financials today. Let us show you how we can help your business save time, reduce costs, and improve overall payroll accuracy.

Don’t let payroll processing take up more of your valuable time. Reach out to RAHA Financials today and discover how our payroll outsourcing solutions can streamline your business operations. Let us handle the details so you can focus on what truly matters—growing your business!