Why Worker Classification Matters:

Correctly classifying workers as employees or independent contractors is essential for businesses. Misclassification can lead to serious tax consequences, including back taxes, penalties, and interest. Employers must evaluate how much control they have over the work being done and how it’s performed to make the right classification.

In general:

- Employees: Employers must withhold income tax, and pay Social Security, Medicare, and unemployment taxes.

- Independent Contractors: Businesses do not withhold or pay payroll taxes.

Are You a Business Owner or a Worker?

If you are self-employed or provide services to clients as an independent party, you are considered a contractor and responsible for your own tax obligations. Refer to the Self-Employed Tax Center for detailed information.

If you hire others to perform services for your business, it is your responsibility to determine their correct classification — as an employee or independent contractor — before paying them.How to Determine Worker

Status:

The IRS uses common law rules to assess whether a worker is an employee or an independent contractor. These rules fall into three categories:

Still Unsure? File Form SS-8:

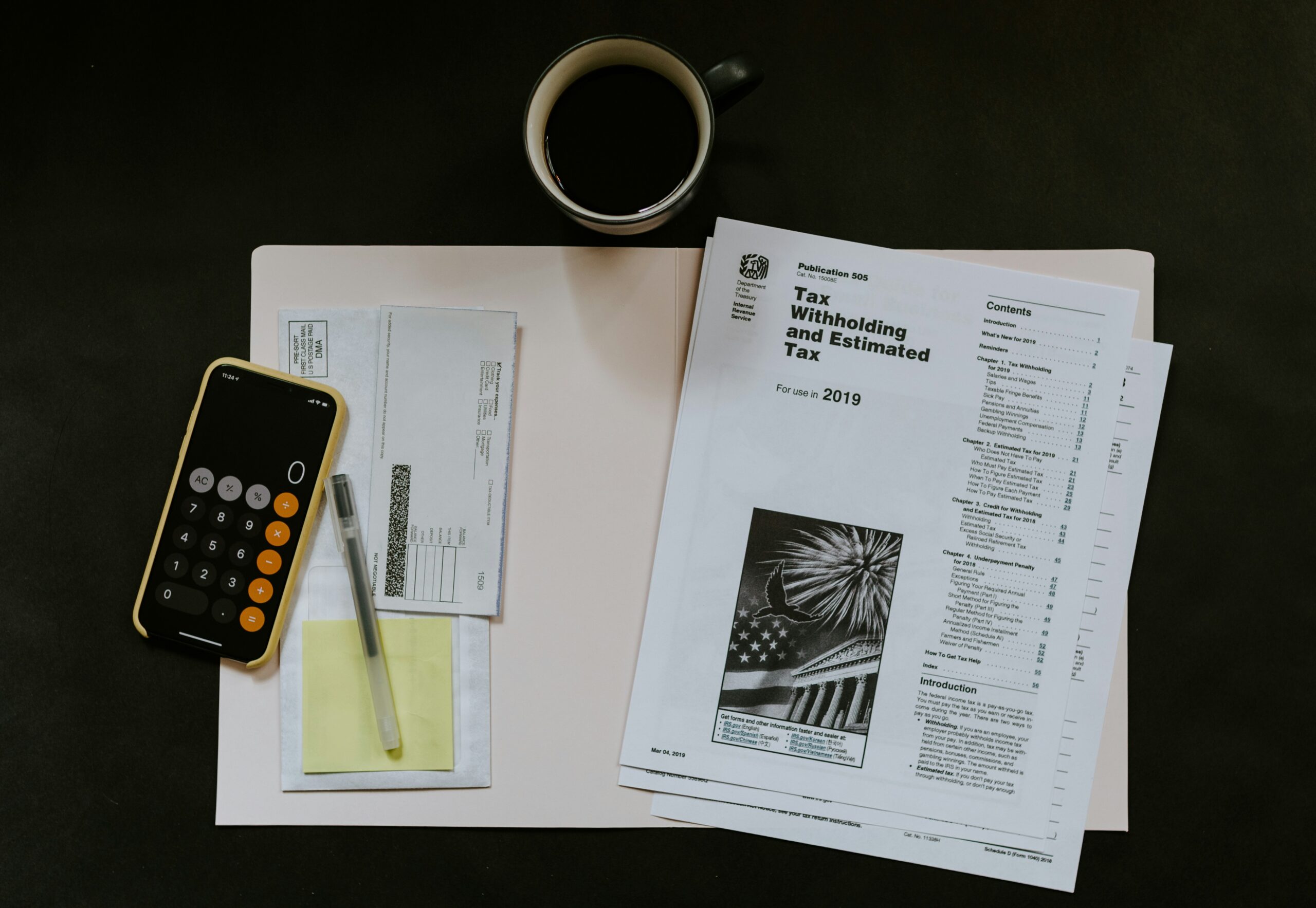

If you’re uncertain whether a worker is an employee or a contractor after reviewing the criteria, you or the worker can file Form SS-8 with the IRS. This form requests a formal determination. Note that the process can take six months or more, but it’s a useful step for businesses hiring similar workers repeatedly.Employment Tax Obligations:

Once a worker’s status is determined, employers must file the proper forms and fulfill their tax responsibilities:

- For employees, withhold income taxes and pay payroll taxes (Social Security, Medicare, unemployment).

- For contractors, provide a Form 1099-NEC for payments of $600 or more annually. Refer to IRS guidance for industry-specific rules and procedures.

Risks of Misclassification:

If you misclassify an employee as an independent contractor without a reasonable basis, you may be liable for:

- Back payroll taxes

- Penalties and interest

- Loss of certain relief protections

Relief Provisions:

You may qualify for relief from employment taxes if you can demonstrate:

- A reasonable basis for treating the worker as a contractor

- Consistent filing of tax forms based on that treatment

- No history of treating similar workers as employees

What If You’ve Been Misclassified?

If you believe you were treated as a contractor but should have been an employee, you can use Form 8919 to calculate and report your share of unpaid Social Security and Medicare taxes.Voluntary Classification Settlement Program (VCSP):

The VCSP offers businesses an opportunity to reclassify workers as employees for future tax years while receiving partial relief from federal employment taxes.

Eligibility requirements include:

- Consistent prior classification as contractors

- Not currently under audit

- Filing Form 8952 to apply

Final Thoughts:

Worker classification isn’t just a technical detail — it’s a fundamental compliance issue that can have a lasting impact on your business. Whether you’re hiring help or working independently, knowing the rules helps you avoid unnecessary legal or tax troubles.

Need help determining your worker classification or filing the correct forms? Our experienced accounting team is ready to guide you through the process.