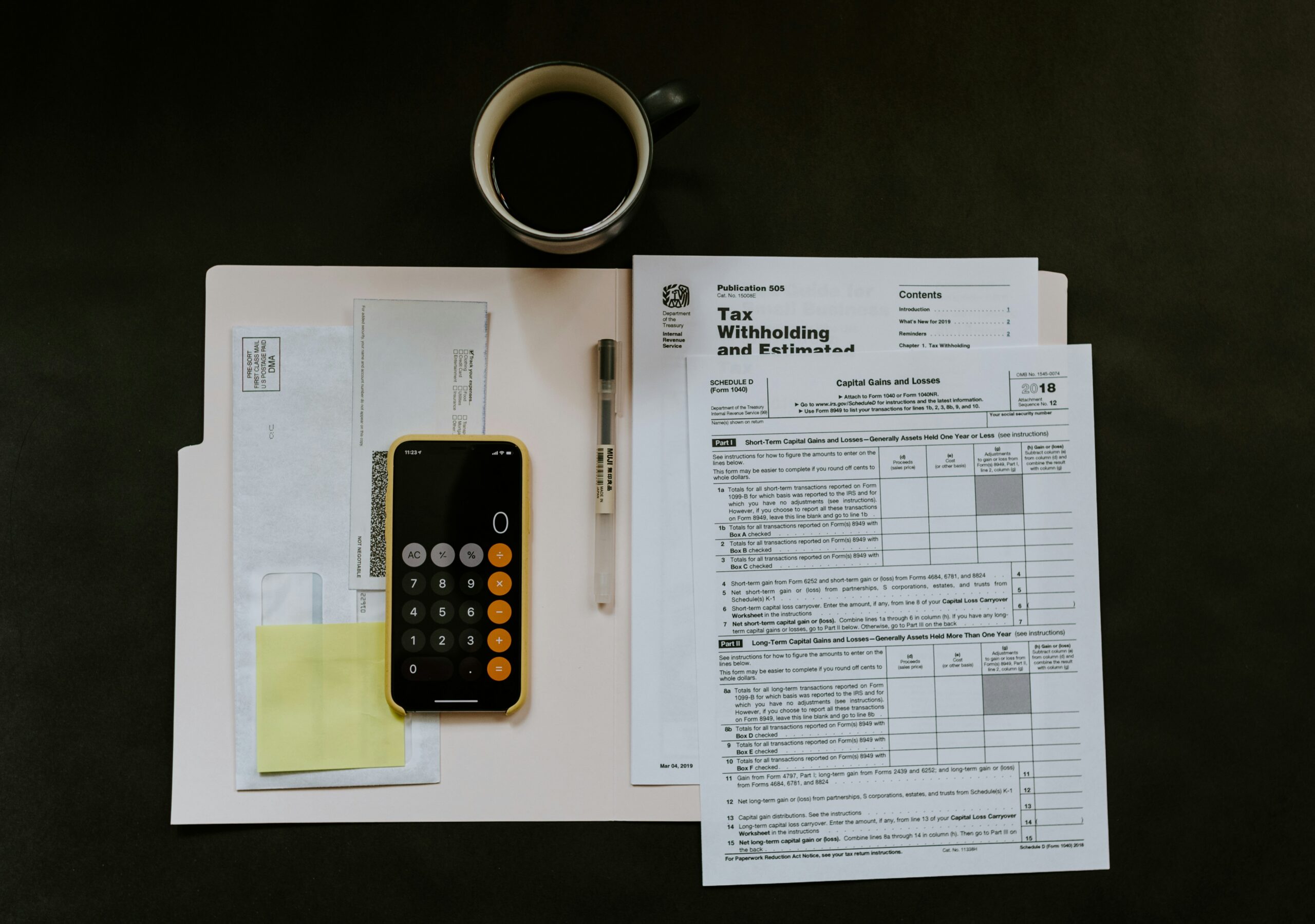

Understanding Estimated Tax:

Estimated tax refers to the method of paying tax on income that is not subject to withholding. This includes income from sources such as self-employment, interest, dividends, alimony, capital gains, rental income, and prizes. If you’re an independent contractor, business owner, or receive other non-wage income, you’re likely required to make these payments.

Estimated tax is not only used to cover income tax, but also self-employment tax and alternative minimum tax (AMT) if applicable.Why Estimated Tax Matters?

If you do not pay enough tax throughout the year — either through withholding or estimated payments — the IRS may assess a penalty for underpayment, even if you’re owed a refund. To avoid this, it’s important to make timely and accurate quarterly payments.Who Needs to Pay Estimated Tax?

Estimated tax generally applies to:

How To Calculate Estimated Tax:

To calculate estimated tax, you need to project your:

- Adjusted gross income (AGI)

- Taxable income

- Deductions and credits

- Total taxes owed

When Are Estimated Tax Payments Due?

The IRS divides the year into four payment periods, each with its own deadline:

- Q1: April 15, 2025

- Q2: June 16, 2025

- Q3: September 15, 2025

- Q4: January 15, 2026

Penalties for Underpayment:

You may face an underpayment penalty if:

- You owe $1,000 or more in tax after subtracting withholdings and credits

- You did not pay at least 90% of the tax for the current year, or 100% of last year’s tax (whichever is smaller)

- The underpayment was due to a casualty, disaster, or extraordinary event

- You retired or became disabled and the underpayment was due to reasonable cause

Final Thoughts:

Staying ahead of your estimated tax responsibilities can save you time, money, and unnecessary stress. If you’re unsure about your requirements, or need help with calculations and filing, our team is here to assist.

Contact us today to schedule a consultation and ensure your estimated taxes are paid accurately and on time.