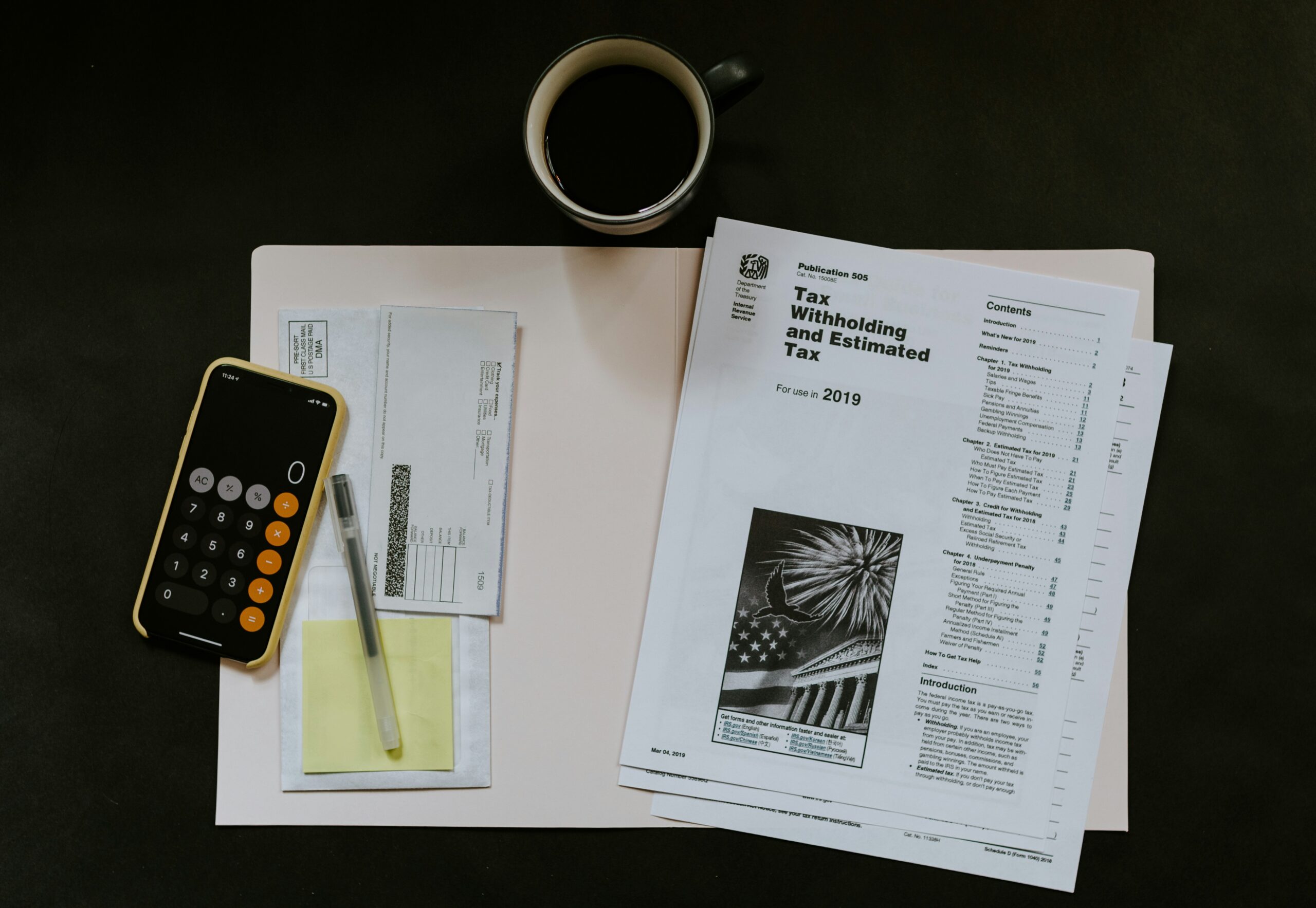

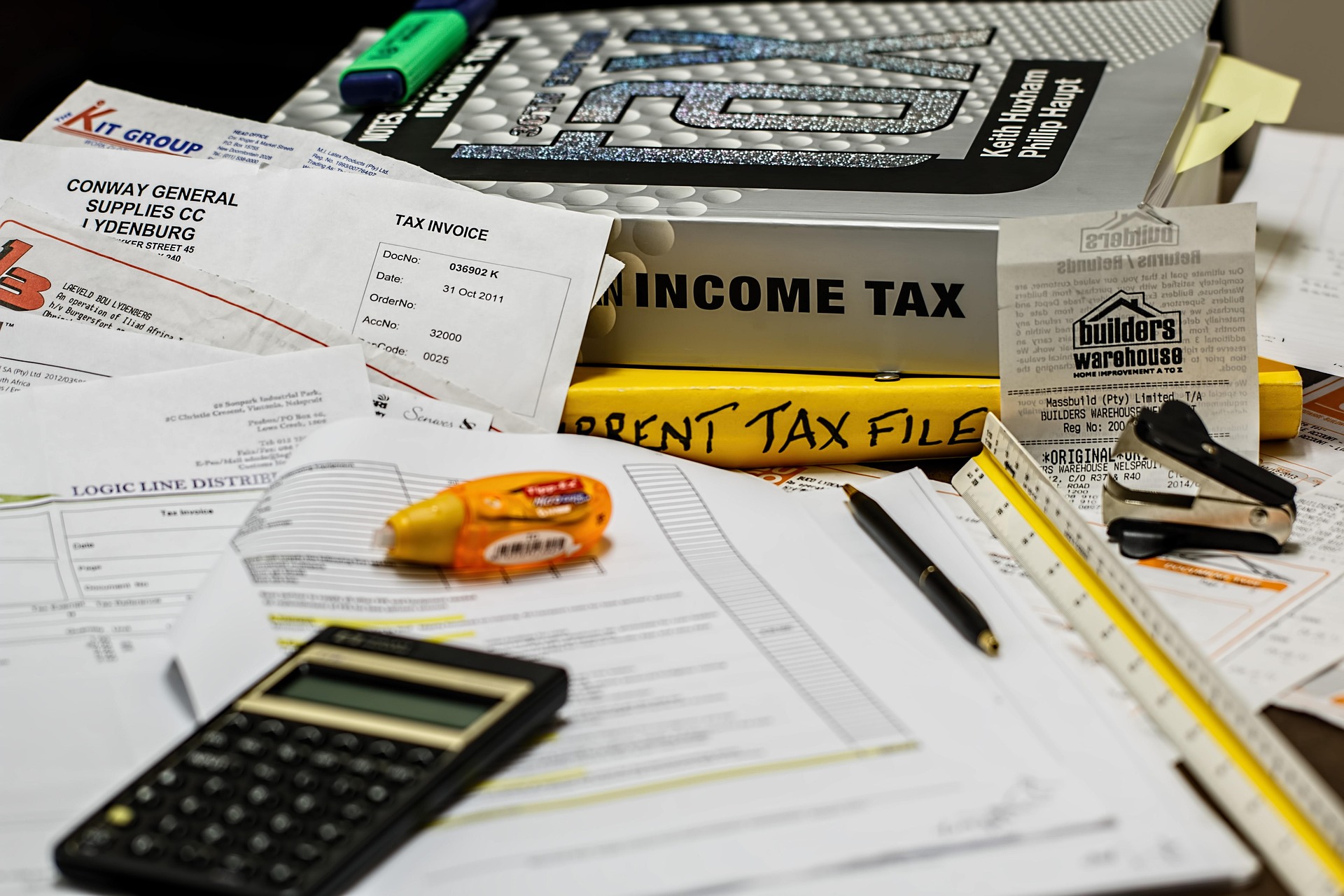

Tax season can feel overwhelming, but with proper documentation and a clear checklist, you can make the process much smoother. Whether you’re working with a professional or filing your own taxes, use this comprehensive 2025 tax checklist to make sure nothing gets missed.Income:

- Gross receipts from sales or services

- Sales records (for accrual-based taxpayers)

- Returns and allowances

- Business checking/savings account interest (1099-INT or bank statements)

- Other income (e.g., affiliate payments, rental income)

Cost of Goods Sold (If Applicable):

- Beginning inventory total (in dollars)

- Inventory purchases during the year

- Ending inventory total

- Inventory taken for personal use

- Materials and supplies used in production

Expenses:Advertising & Communication

- Marketing and advertising costs

- Landline, fax, or mobile phones used for business

- Computer and internet expenses

Transportation & Travel

- Local transportation (bus, Uber, taxis, etc.)

- Mileage logs or actual vehicle expenses

- Business travel (airfare, hotels, meals, tips) and internet expenses

- Internet expenses incurred during travel

Contractors & Commissions

- Amounts paid to subcontractors or freelancers

- Required Forms 1099-MISC and 1096

Depreciation

- Cost and date of purchase for assets

- Records of personal vs. business use

- Sales or disposals of business assets

Insurance

- General business insurance

- Errors and omissions (E&O) coverage

- Casualty loss coverage

Interest Expenses

- Mortgage interest on business property

- Interest on business loans

- Investment-related interes

Professional Services

- Legal, accounting, and consulting fees

Office Supplies

- Pens, paper, staples, printer ink, and other consumables

Rent Expenses

- Office space rent

- Business-use vehicle lease payments

Office-in-Home Deduction:

- Square footage of home used exclusively for business

- Total home square footage

- Mortgage interest or rent payments

- Home insurance

- Utilities

- Cost of home and improvements

- First date of business use

- Hours of use (for daycare providers)

Wages & Payroll Taxes:

- Form W-2 and W-3

- Federal payroll returns (Forms 940, 941)

- State payroll tax filings

- Federal payroll returns (Forms 940, 941)

- Employee benefit expenses (e.g., health insurance, retirement plans)

Contractors

- Amounts paid to independent contractors

- Filed Form 1099-MISC and 1096 as required

Other Business Expenses:

- Repairs and maintenance of office or equipment

- Equipment rentals

- Software subscriptions

- Bank fees

- Health insurance (self-employed or for partners/shareholders)

- Estimated tax payments made during the year

- Other eligible business-related costs

Partner with RAHA Financials for Stress-Free Tax Season

Staying on top of your small business taxes doesn’t have to be overwhelming. With the right preparation, strategic planning, and professional support, you can turn tax season into an opportunity to strengthen your financial foundation and plan confidently for the future.

At RAHA Financials, we specialize in helping small businesses like yours navigate tax time with clarity and confidence. From bookkeeping and tax planning to filing and business consulting, our team offers comprehensive financial solutions tailored to your unique needs. Whether you’re just getting started or looking to scale, RAHA Financials is your trusted partner for year-round peace of mind.

Let us handle the numbers—so you can focus on growing your business.

👉 Contact us today to schedule a consultation and experience the RAHA difference.