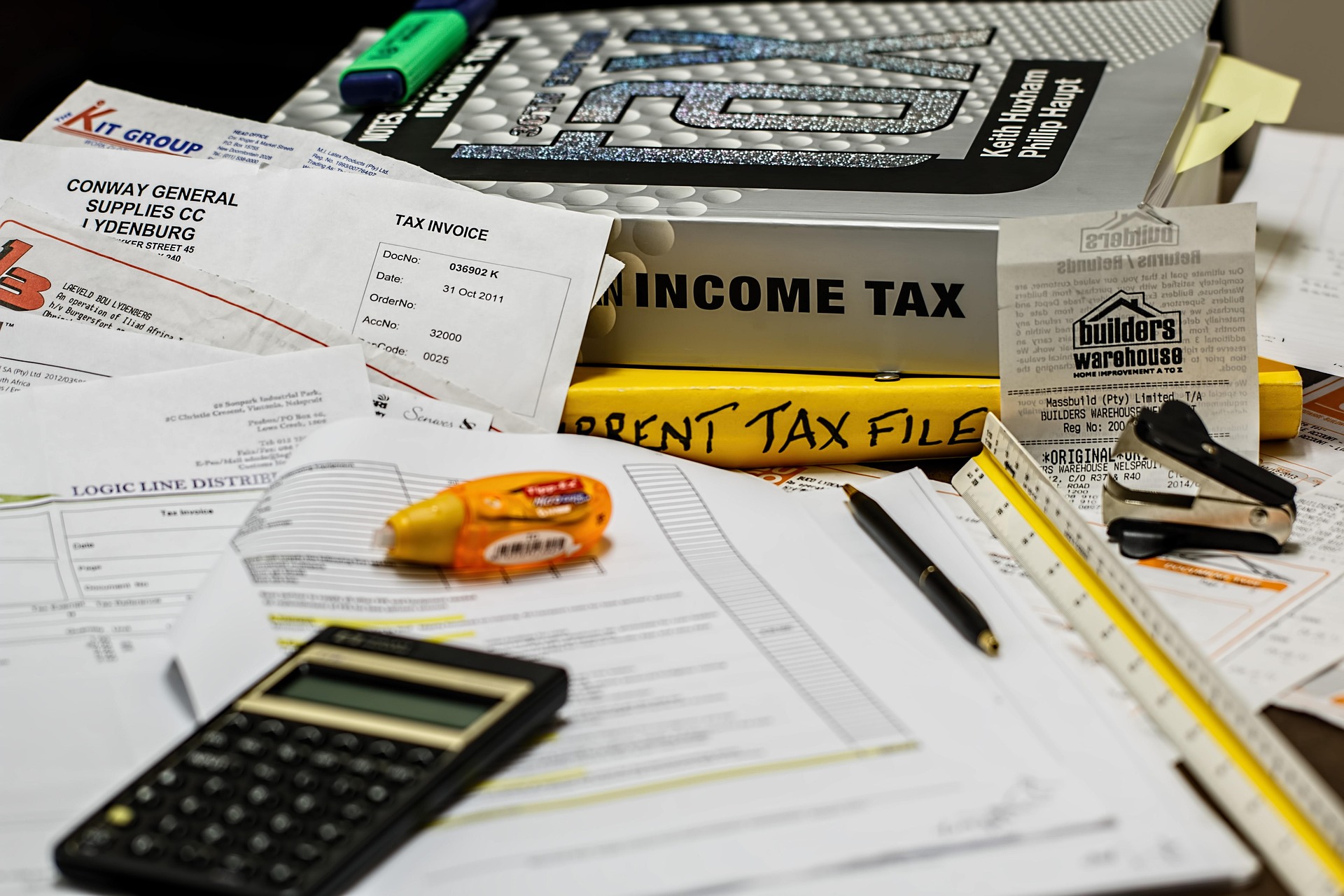

In the retail industry, time is money. Every moment spent on administrative tasks like payroll processing and bookkeeping is time taken away from growing your sales and enhancing customer experience. By automating payroll and streamlining your bookkeeping processes, retail businesses can focus on what matters most—boosting sales and expanding their reach. In this blog, we’ll explore how retail payroll automation, bookkeeping integration, and outsourcing payroll services can transform your business operations, helping you stay compliant while saving time and money.

What is Retail Payroll Automation and How Can It Help Your Business?

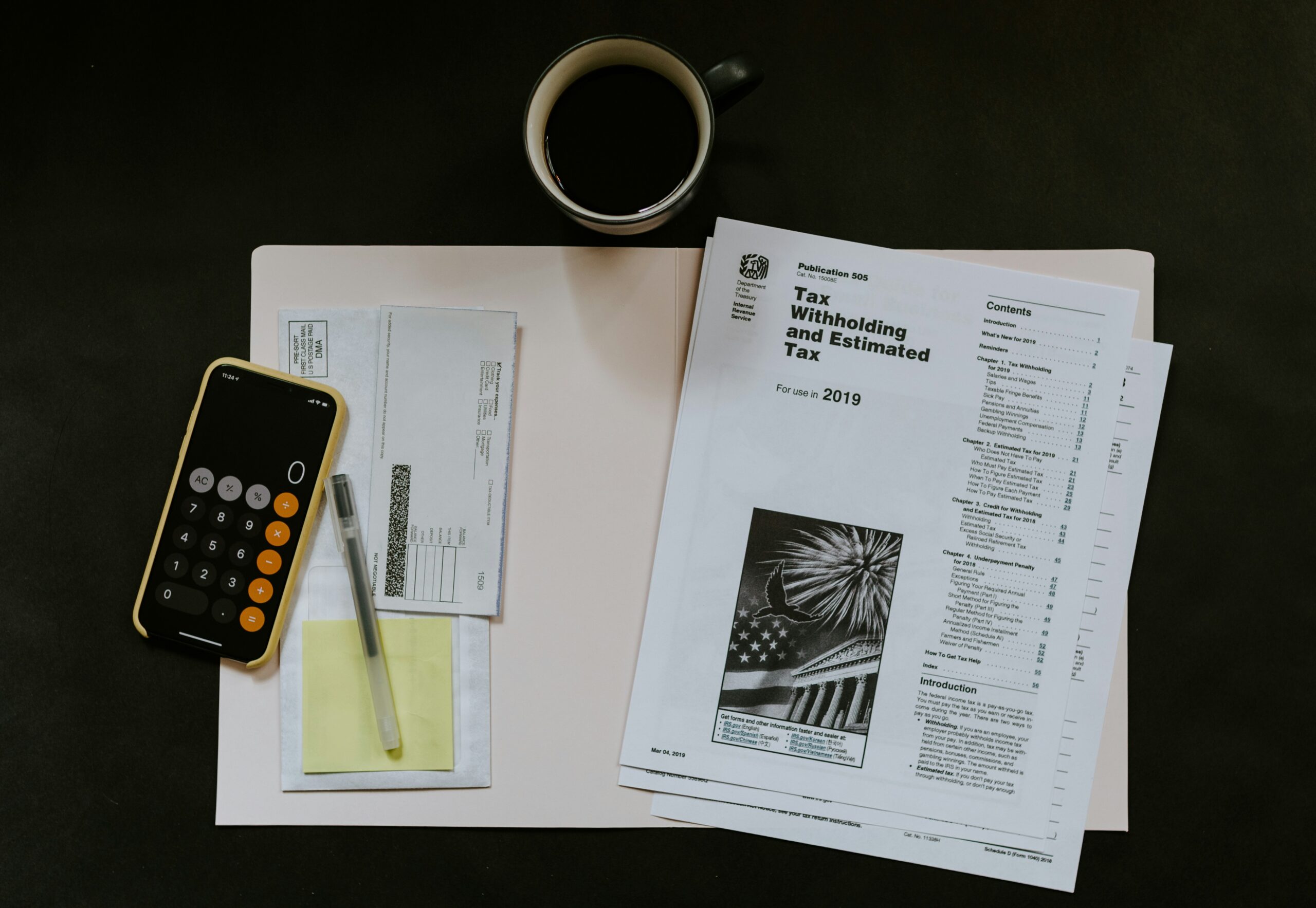

Retail payroll automation refers to using technology to process payroll, calculate wages, and handle tax deductions without manual intervention. For retailers, this means that tasks like time tracking, salary computation, and tax filing are handled seamlessly, reducing errors and ensuring timely payments.

How Retail Payroll Automation Benefits Retailers:

- Reduced Payroll Errors: Manual payroll systems are prone to mistakes. Automating your payroll minimizes human errors, ensuring accurate payments every time.

- Time Savings: Automating payroll frees up valuable time that you can reinvest into strategic business activities like marketing and customer service.

- Regulatory Compliance: Automated payroll solutions ensure your payroll system remains compliant with local tax laws, avoiding costly fines and audits.

By automating payroll, retailers can ensure a smoother and more efficient operation, focusing their energy on increasing sales rather than dealing with administrative headaches.

Streamline Bookkeeping for Retail Businesses with Integrated Payroll Solutions

Bookkeeping for retail businesses involves tracking income, expenses, sales taxes, and inventory, among other financial tasks. When payroll is integrated with bookkeeping systems, retailers can track payroll expenses alongside other financial data, offering a holistic view of their business’s financial health.

Why Retailers Need Bookkeeping and Payroll Integration:

- Real-Time Financial Data: Integrating payroll services for retailers with bookkeeping systems ensures that every transaction, from employee wages to inventory expenses, is recorded in real-time. This allows for more accurate financial reporting and quicker decision-making.

- Seamless Tax Reporting: With integrated payroll, tax calculations and deductions are automatically synced with your bookkeeping system, reducing the risk of tax compliance errors and making filing taxes much easier.

- Efficient Reconciliation: Integrating payroll with your bookkeeping system makes reconciling accounts faster and more accurate, improving financial clarity and operational efficiency.

This integration saves time, reduces errors, and ensures that payroll expenses are accurately recorded and managed within your broader retail accounting services.

Outsource Payroll for Retail Businesses to Focus on Sales Growth

For retail business owners, especially small retailers, managing payroll in-house can be overwhelming and distract from core business activities. Outsourcing payroll for retail stores is an effective way to ensure accurate, timely, and compliant payroll processing without the burden of administrative overhead.

Benefits of Outsourcing Payroll for Retailers:

- Time Efficiency: Outsourcing payroll eliminates the time spent on payroll tasks, allowing you to focus on sales and business growth.

- Expertise in Tax Compliance: Payroll service providers specialize in ensuring your business remains compliant with ever-changing tax regulations, which is especially crucial for retail stores with multiple employees and varying pay structures.

- Cost Savings: By outsourcing payroll, you avoid the need for a dedicated in-house payroll team, reducing overhead costs and increasing profitability.

Automated Payroll Solutions for Retail Finance Management

Automated payroll solutions don’t just help with payroll processing—they also integrate seamlessly with retail finance management tools. This creates an efficient flow of financial data, from sales revenue to operational costs, providing you with comprehensive insights into your business’s performance.

How Automated Payroll Helps Retail Finance Management:

- Automated Tax Filing: Payroll automation ensures that tax filings are automatically completed and submitted on time, reducing the risk of missed deadlines and penalties.

- Data-Driven Decision Making: With real-time payroll and financial data, you can easily track key performance indicators (KPIs) and make more informed decisions about your retail operations.

- Scalability: As your retail business grows, automated payroll solutions can scale with you, handling more employees, transactions, and taxes without additional manual work.

By leveraging automated payroll solutions in your retail finance management, you streamline processes, increase efficiency, and ensure that your business is positioned for growth.

POS-Integrated Payroll: The Key to Streamlining Payroll and Sales Growth

Integrating payroll with your Point of Sale (POS) system can greatly enhance the efficiency of payroll processing, especially in retail environments where employee hours and sales are closely tied. With POS-integrated payroll, data from employee shifts is automatically captured and processed, ensuring that employees are paid accurately for the hours worked.

Advantages of POS-Integrated Payroll for Retailers:

- Accurate Payment for Hours Worked: Employees are paid accurately based on their hours worked as recorded in the POS system, reducing discrepancies and ensuring fair compensation.

- Streamlined Workflow: With integrated payroll and POS, all data is synced automatically, eliminating the need for manual data entry and improving operational efficiency.

- Improved Employee Satisfaction: Timely and accurate pay improves employee morale, reduces turnover, and increases productivity.

POS-integrated payroll ensures that the focus remains on sales growth by automating payroll and minimizing errors, leaving retailers with more time to enhance customer experiences.

RAHA Financials—Your Trusted Partner for Retail Payroll and Bookkeeping Automation

At RAHA Financials, we specialize in offering retail payroll automation, bookkeeping services, and comprehensive accounting solutions designed to help retailers focus on what they do best growing their business. Our automated payroll solutions ensure that your retail payroll is processed seamlessly, accurately, and on time, while our bookkeeping services help you keep your finances organized and compliant.

We offer tailored retail accounting services, including POS-integrated payroll and outsourced payroll options, so you can streamline your operations and drive sales growth. Our team of experts is committed to helping you navigate the complexities of payroll and bookkeeping, ensuring that your business is set up for success.

Ready to automate your payroll and focus on driving sales? Contact RAHA Financials today to discover how our retail payroll automation and bookkeeping services can save you time, reduce errors, and help your business thrive. Let us handle your payroll, so you can handle your growth!

FAQ:

1. What is retail payroll automation?

Retail payroll automation refers to the use of technology to manage payroll processing, including calculating employee wages, deductions, tax filings, and pay distribution, without manual intervention. This system helps save time, reduce errors, and ensure timely and accurate payroll processing.

2. How can retail businesses save time with automated payroll?

Automated payroll solutions eliminate the need for manual calculations and data entry, significantly reducing time spent on payroll management. With automated systems, you can streamline payroll processes, ensure compliance with tax regulations, and focus more on growing your sales.

3. Can payroll automation integrate with my POS system?

Yes! Many automated payroll systems offer POS integration, allowing you to capture employee hours directly from your POS system and ensure accurate payroll processing. This integration streamlines workflows and reduces the risk of errors.

4. Is outsourcing payroll services a good option for small retail businesses?

Yes! Outsourcing payroll services for retailers is an effective way for small businesses to save time and ensure compliance with tax regulations. It allows retailers to focus on sales and business growth while leaving payroll management to experts.

5. How does bookkeeping for retail businesses integrate with payroll systems?

By integrating payroll with bookkeeping systems, you can ensure that payroll expenses are recorded in real time, improving the accuracy of financial reports. This integration also helps streamline tax filings and keeps your business organized financially.

6. What are the benefits of using RAHA Financials for retail payroll automation?

RAHA Financials offers customized automated payroll solutions for retail businesses, ensuring accurate, timely payroll processing. We help you integrate your payroll with bookkeeping, maintain tax compliance, and free up time for you to focus on sales growth and business expansion.