Accounting Solutions

Unlocking Financial Success: The Core of an Accounting Service Businesses. Q. What are accounting service firms? Due to financial complexities that businesses find themselves in, these firms play a major role in providing guidance and support to the affected companies. Accounting services firms have a wide range of personalized services for individual corporations such as; […]

Guide to Form 1040 Tax Return with RAHA Financials

Restructure Your Tax Journey with RAHA Financials: Form 1040 USA Tax Return. The 1040 tax return is a form that people in the United States use to tell the government about their earnings and figure out how much income tax they owe. It’s like a summary of your financial year, where you report your income […]

Navigating Tax Season in the Steel City: A Guide to Tax Services in Pittsburgh

What is the local services tax in Pittsburgh PA? Pittsburgh, PA, the civic Local Service Tax (LST) is a tax imposed upon every businessperson operating within the city. It is generally regarded as the “Pittsburgh Local Services Tax” or “Pittsburgh LST” for short, which aims at raising funds for a range of vital municipal functions, […]

No More Financial Fog: A Clear Guide to US Bookkeeping for Startups

In the United States, there is a relentless drive to achieve the American dream of owning a successful business. From coast to coast, the nation is brimming with ambitious entrepreneurs bringing their ideas to life. However, in the midst of this exhilarating journey, one crucial element often ends up overlooked – bookkeeping. But do not […]

Understanding Business Accounting Services: A Comprehensive Overview

What is Business Accounting Services used for? Management accounting serves several important purposes that are critical to the fulfillment and sustainability of an organization: Why do businesses need accounting services? Companies need accounting services for numerous reasons: What is the function of Accounting Services? We eliminate the burden of daily data entry and record-keeping, ensuring […]

Discover the Comprehensive Bookkeeping Services List: Your Partner in Financial Clarity

Discover the complete list of our top-notch bookkeeping offerings and see how we may be your last accomplice in reaching monetary readability. In ultra-modern fast-paced and ever-changing commercial enterprise panorama, keeping accurate and reliable economic facts is a vital aspect of fulfillment. This is where in bookkeeping offerings come into play, providing worthwhile help via […]

Guide to Accounting and Bookkeeping Services in the USA

How Accounting Services Drive Business Success Accounting & bookkeeping services in USA are vital for businesses, serving as the systematic recording, summarizing, analyzing, and reporting of financial transactions. This ensures accuracy, transparency, and obedience with regulatory standards. In the USA, accounting has moved beyond just analyzing data to become a valuable tool for making smart […]

2025 Tax Deadlines: Important Dates You Should Know USA

As we move into a new financial year, it’s crucial for individuals and businesses to stay informed of key tax deadlines. Filing your taxes on time not only ensures compliance but also helps avoid penalties, interest, and missed financial opportunities.Individual Tax Filing Deadline:Tuesday, April 15, 2025 This is the official due date for filing Form […]

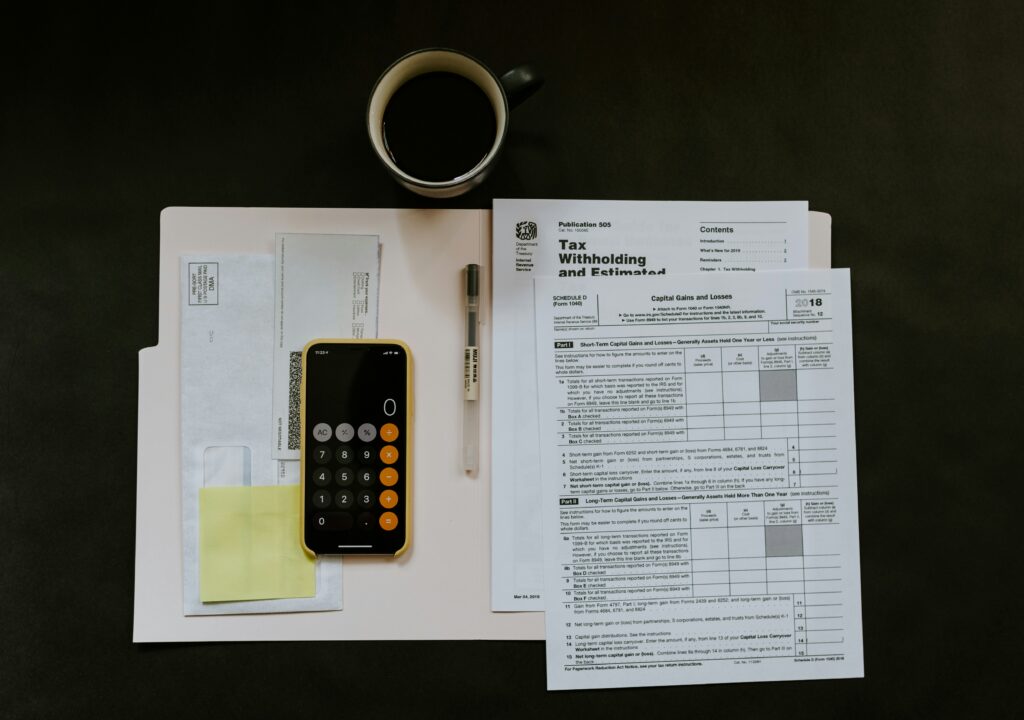

What Is Estimated Tax?

Understanding Estimated Tax: Estimated tax refers to the method of paying tax on income that is not subject to withholding. This includes income from sources such as self-employment, interest, dividends, alimony, capital gains, rental income, and prizes. If you’re an independent contractor, business owner, or receive other non-wage income, you’re likely required to make these payments. Estimated […]

Independent Contractor vs Employee: A Tax Guide for Business Owners

Why Worker Classification Matters: Correctly classifying workers as employees or independent contractors is essential for businesses. Misclassification can lead to serious tax consequences, including back taxes, penalties, and interest. Employers must evaluate how much control they have over the work being done and how it’s performed to make the right classification. In general: Are You […]